Utility Poles Industry

Summary:

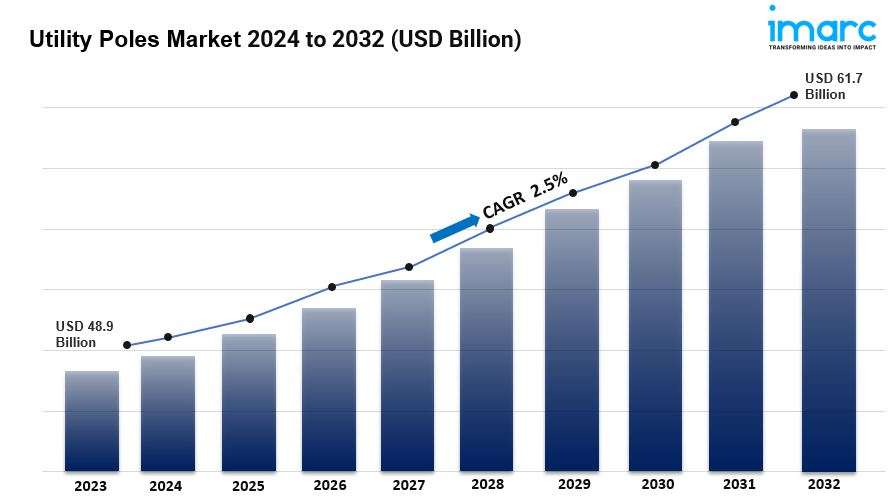

- The global utility poles market size reached US$ 48.9 Billion in 2023.

- The market is expected to reach US$ 61.7 Billion by 2032, exhibiting a growth rate (CAGR) of 2.5% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest utility poles market share.

- Distribution poles accounts for the majority of the market share in the type of segment due to their vital role in regional networks for the distribution of electricity.

- Wood holds the largest share in the utility pole industry.

- Between 40 and 70ft remain a dominant segment in the market because they offer enough height for both functionality and safety.

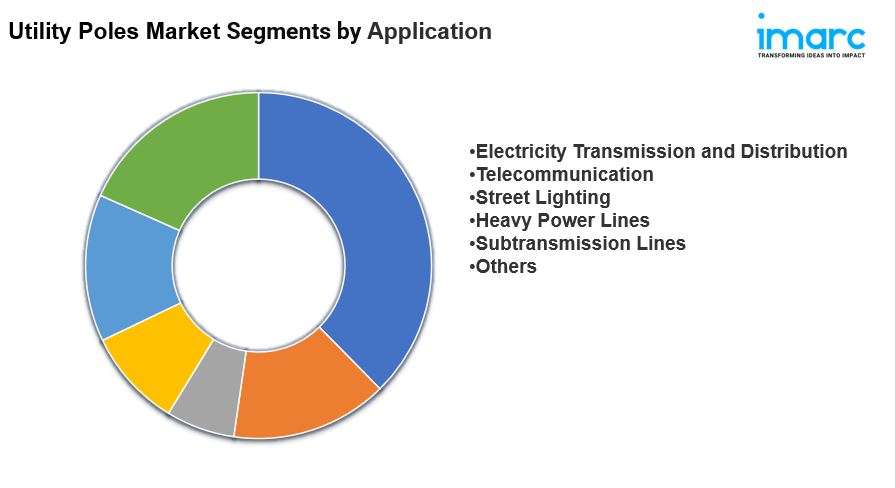

- Electricity transmission and distribution represents the leading application segment.

- The increasing adoption of electric vehicles (EVs) is driving the demand for utility poles to support the expansion of EV charging infrastructure, which requires enhanced power distribution networks.

- Rising investments in disaster-resilient infrastructure are promoting the use of stronger and more durable utility poles as regions seek to minimize damage from natural disasters such as hurricanes and floods.

- Utility poles, also known as electric power poles, play a crucial role in the transmission and distribution of electricity from power companies to end users, and are a significant component of the utility poles market size.

Industry Trends and Drivers:

Expansion of energy infrastructure: With increasing urbanization, industrialization, and the adoption of renewable energy sources, the demand for electricity is rising globally. This growth requires the development of new transmission and distribution networks, which in turn boosts the demand for utility poles. Utility poles are essential for supporting overhead power lines that transmit electricity to residential, commercial, and industrial areas. As countries continue to develop and integrate renewable energy sources such as solar and wind power, the need for robust and expanded electrical grids further stimulates the market for utility poles. Moreover, rural electrification programs in emerging economies are crucial for extending power supply to remote and underserved regions, thus contributing to the market growth.

Modernization of telecommunications networks: The telecommunications industry is undergoing a significant transformation with the rollout of fifth-generation (5G) networks and the expansion of high-speed broadband services. Utility poles play a crucial role in supporting these networks by providing the infrastructure needed for the installation of fiber-optic cables, wireless antennas, and other communication equipment. With the growing demand for faster internet speeds, increased data capacity, and enhanced connectivity, telecom companies are investing heavily in upgrading their networks. Additionally, the rise of smart cities and the Internet of Things (IoT) as they serve as platforms for mounting sensors, cameras, and other devices that support intelligent infrastructure bolstering the market demand.

Need for replacement and upgrading of aging pole infrastructure: Many utility poles currently in use have been in service for decades and are reaching the end of their lifespan. Aging poles are more susceptible to damage from environmental factors such as storms, high winds, and seismic activity, leading to power outages and safety hazards. As a result, utility companies are investing in the replacement of deteriorating poles to ensure the reliability and safety of their power and telecommunications networks. Moreover, the shift towards more durable and resilient materials, such as steel and composite poles, is encouraging the replacement of traditional wooden poles with modern alternatives that offer longer lifespans and lower maintenance requirements, thus aiding the market demand.

Request for a sample copy of this report: https://www.imarcgroup.com/utility-poles-market/requestsample

Utility Poles Market Report Segmentation:

Breakup By Type:

- Transmission Poles

- Distribution Poles

Distribution poles represent the leading segment due to their critical role in local electricity distribution networks.

Breakup By Material:

- Concrete

- Wood

- Steel

- Composites

Wood dominates the market due to its cost-effectiveness, ease of availability, and suitability for various climates.

Breakup By Pole Size:

- Below 40ft

- Between 40 and 70ft

- Above 70ft

Poles between 40 and 70 ft account for the majority of shares as they are ideal for most utility applications, providing sufficient height for safety and functionality.

Breakup By Application:

- Electricity Transmission and Distribution

- Telecommunication

- Street Lighting

- Heavy Power Lines

- Subtransmission Lines

- Others

Electricity transmission and distribution exhibits a clear dominance as they are required for extensive pole infrastructure for grid expansion and maintenance.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position owing to rapid urbanization, infrastructure development, and large-scale rural electrification projects.

Top Utility Poles Market Leaders:

The utility poles market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- El Sewedy Electric Company

- FUCHS Europoles GmbH

- Hill & Smith Holdings PLC

- KEC International Ltd

- Koppers Inc.

- Nippon Concrete Industries Co. Ltd.

- Omega Company

- Pelco products Inc.

- Skipper Limited

- Stella-Jones and Valmont Industries Inc.

Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=4086&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.