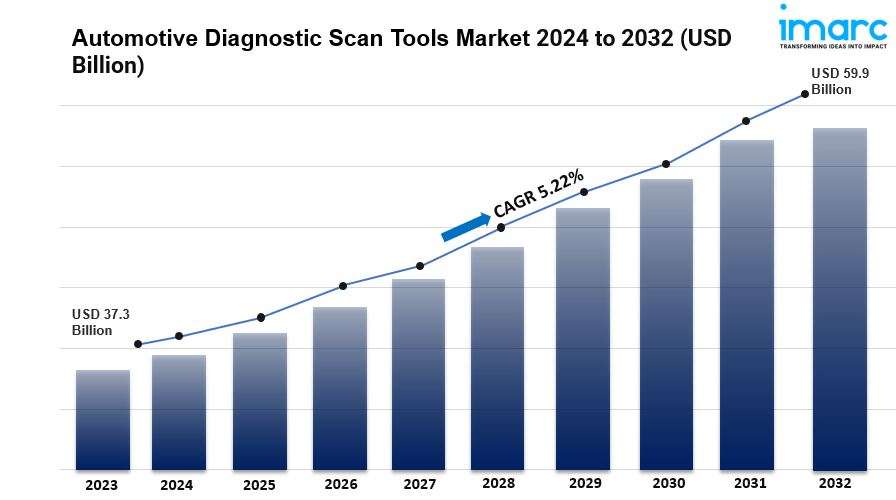

Automotive Diagnostic Scan Tools Market Size 2024-2032:

- The global automotive diagnostic scan tools market size reached US$ 37.3 Billion in 2023.

- The market is expected to reach US$ 59.9 Billion by 2032, exhibiting a growth rate (CAGR) of 5.22% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest automotive diagnostic scan tools market share.

- Diagnostic hardware accounts for the majority of the market share in the offering type segment because of its crucial function in offering the required interface for communication between diagnostic software and automobile electronic systems.

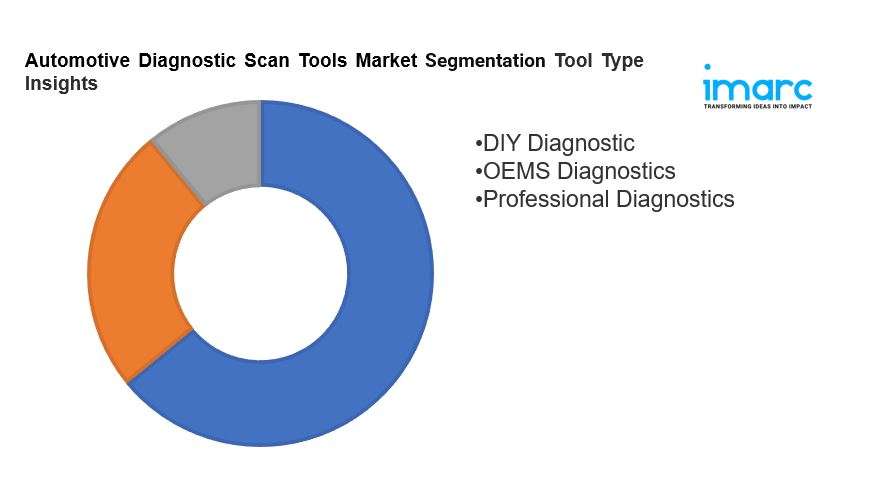

- Professional diagnostics hold the largest share in the automotive diagnostic scan tools industry.

- IC engine vehicles remain a dominant segment in the market, as they continue to be the most common kind of automobile on the road, requiring diagnostic equipment for upkeep and repairs.

- Passenger vehicles represent the leading application segment.

- The increasing adoption of telematics and connected car technologies, which require advanced diagnostic tools to analyze data from remote vehicle monitoring and provide real-time insights for maintenance and repair, is impelling the market demand.

- The rising trend of do-it-yourself (DIY) vehicle maintenance among consumers, leading to a higher demand for user-friendly diagnostic tools that enable car owners to troubleshoot issues independently, is aiding the automotive diagnostic scan tools market size.

Industry Trends and Drivers:

- The increasing complexity of automotive electronics:

Modern vehicles are equipped with a wide array of advanced electronic systems, including sensors, control modules, and onboard computers that monitor and control various functions such as engine performance, braking, transmission, and safety features. As these systems become more sophisticated, it becomes essential for repair shops and service technicians to have advanced diagnostic tools that can interface with these electronic control units (ECUs) to identify and resolve issues accurately. The shift towards electric vehicles (EVs) and hybrid vehicles (HEVs) further amplifies the need for specialized diagnostic tools capable of handling the unique components and technologies of these vehicles. Consequently, the increasing reliance on electronics in vehicles that can keep up with the evolving technology is bolstering the market demand.

- Stringent government regulations for vehicle emissions and safety:

Regulatory bodies across the globe are imposing stricter standards for emissions control, fuel efficiency, and vehicle safety, forcing manufacturers to integrate more complex diagnostic systems to monitor compliance. For instance, onboard diagnostics (OBD) systems are now mandatory in many regions, enabling real-time monitoring of engine performance and emissions levels. These systems generate diagnostic trouble codes (DTCs) that can only be interpreted with diagnostic scan tools, making these tools essential for ensuring that vehicles meet regulatory requirements. In addition to emissions, safety regulations have also expanded with the inclusion of advanced driver assistance systems (ADAS), requiring diagnostic tools to perform calibrations and tests on safety features such as lane-keeping assist, automatic emergency braking, and adaptive cruise control.

- The growing demand for vehicle maintenance and repair services:

With the global increase in vehicle ownership, coupled with the rising average age of vehicles on the road, there is a growing need for regular maintenance and repair services. Diagnostic scan tools are essential for service centers and workshops to quickly diagnose and troubleshoot issues, reducing the time spent on repairs and improving overall service efficiency. As vehicles become more complex, consumers expect faster and more accurate diagnostics, making advanced scan tools a necessity for professional technicians. Furthermore, the growth of aftermarket services, including independent repair shops and mobile mechanics, that are user-friendly and capable of diagnosing a wide range of vehicle models is supporting the market demand.

Request for a sample copy of this report: https://www.imarcgroup.com/automotive-diagnostic-scan-tools-market/requestsample

Automotive Diagnostic Scan Tools Market Report Segmentation:

Breakup By Offering:

- Diagnostic Hardware

- Diagnostic Software

- Diagnostic Services

Diagnostic hardware accounts for the majority of shares due to its essential role in providing the necessary interface for communication between vehicles' electronic systems and diagnostic software.

Breakup By Tool Type:

- DIY Diagnostic

- OEMS Diagnostics

- Professional Diagnostics

Professional diagnostics dominate the market as automotive service providers require advanced tools for comprehensive diagnostics and troubleshooting of complex vehicle systems.

Breakup By Propulsion Type:

- IC Engine Vehicles

- Electric Vehicles

IC engine vehicles hold the largest market size because they remain the most prevalent type of vehicle on the road, necessitating diagnostic tools for maintenance and repair.

Breakup By Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

Passenger vehicles represent market dominance as they constitute a significant portion of the automotive fleet, leading to higher demand for diagnostic tools for personal transportation.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position due to rapid automotive industry growth, high vehicle production rates, and increasing consumer demand for advanced vehicle maintenance solutions in emerging markets.

Top Automotive Diagnostic Scan Tools Market Leaders:

The automotive diagnostic scan tools market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Actia Group

- Autel Intelligent Technology Corp. Ltd.

- AVL DiTEST GmbH (AVL List GmbH)

- Continental AG

- Delphi Technologies (BorgWarner Inc.)

- Fluke Corporation (Fortive Corporation)

- Robert Bosch GmbH (Robert Bosch Stiftung GmbH)

- Snap-On Incorporated

- Softing AG

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=7052&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145